Millennials in Vietnam make up a large percentage of the workforce, giving them the chance to earn a paycheck and pay bills. There's also a rising consumer trend where millennials are spending more on experiences such as vacations compared to the older generation, who were focused on assets and savings. However, even with more disposable income on hand, it's financially prudent for any millennial to be prepared for anything. Having emergency savings will help a person stay afloat if they suffer a serious personal crisis.

An emergency savings fund is money set aside and quickly accessed to deal effectively with any unexpected changes in your life, such as losing a job, facing a serious illness, or needing to fix your car engine. Starting and maintaining the fund will significantly reduce your financial stress and give you space to achieve other financial goals.

Challenges of Starting an Emergency Fund

For the fund to be useful, you have to spend only on emergency expenses and not on eating out or vacations. However, in reality, it's not a very pleasant activity as it puts you in a negative mindset of planning for some unfortunate event.

Your level of income and current living situation will also significantly determine if you can save extra money in your emergency kitty. You may have to adjust your lifestyle, such as minimizing entertainment expenses, making the process discomforting. Or you may be financing a loan, placing more strain on your finances.

However, it's risky to have a false sense of security even in a growing and stable economy. We've all witnessed how a crisis like Covid-19 has threatened millions of livelihoods and caused unprecedented financial emergencies. An emergency fund is always necessary for such a time.

How COVID-19 Stresses the Need for Emergency Funds

The world never anticipated the arrival of Covid-19, which caused significant challenges for the majority of the population. Many lost jobs, businesses closed down, and lockdowns were the norm. If there's anything the Covid-19 pandemic has taught society, it is the need to be prepared at all times.

Anyone who had an emergency fund was fortunate as this means they could survive for some time even if they lost their income abruptly. They would also have avoided getting into credit card debt or drawing from investments for survival.

Even as the Vietnam economy recovers, it's hard to predict how long the crisis impacts will stretch. Therefore, it's imperative to start building an emergency fund now. It needs to be a culture, so you're not worried about the future.

How Much Should I Have In My Emergency Fund?

Generally, you are required to save at most 3 to 6 months of your living expenses. But this is not a fixed rule as everyone has different levels of income and lifestyle. You can decide to save beyond 6 months' worth of expenses. With the pandemic, it would be advisable to keep saving more, especially if a person earns a small paycheck.

As you start, be realistic based on your circumstances and have an amount in mind that will adequately meet your needs.

What Types of Savings Account Should I Use for an Emergency Fund?

The best place to save your emergency fund is in a separate savings account, where it's easy to access whenever you need it. The following are options majorly recommended to keep your emergency funds.

1. High Yield Savings Account

A high yield savings account typically has better interest rates than most regular savings accounts. Some banks such as Saigon Bank and Nam A bank offer online savings rates between 7,15% and 7,4% annually, which are higher than traditional deposits by 0,9 to 1,2%. As your money's value grows with interest, you can also withdraw it online. However, always consider factors such as fees and terms involving online accounts.

2. Traditional Bank Account

A regular bank account is still another option if you can't open a high yield savings account or money market fund. In case you need cash immediately, you can just walk into your bank or use an ATM. It's also easy to be tempted to withdraw the money for impulse spending, which defeats the purpose. If you can, open a separate savings and checking account for the savings in the same bank to instill discipline.

What Are the Tips for Building an Emergency Fund?

Building an emergency fund doesn't have to be a challenging task. Here are a few tips to help you prepare for any financial challenges and achieve your savings target.

- Start small: You can build your fund slowly, and eventually, you will have considerable savings. Automate your savings, so it's a routine every week or month where you transfer money from your checking into your savings account. Maintain consistency until you attain at least 3 to 6 months of savings. Once you reach your objective, continue to save for the long term.

- Review your budget: Budgeting helps to determine how much money you can spare for emergencies. Divide your expenses into needs and wants and whatever money remains, put it in your emergency fund. This also reveals where you're overspending, enabling you to reallocate the extra cash to your living expenses.

- Add extra income: With the extra money, you get to save more and faster. If you have a job where you're a great value addition, you will be free to ask for a salary raise. You can also explore other side hustles, such as being a tour guide or freelancing. Try as much as you can to save an extra percentage of your income incrementally instead of sticking to your original amount.

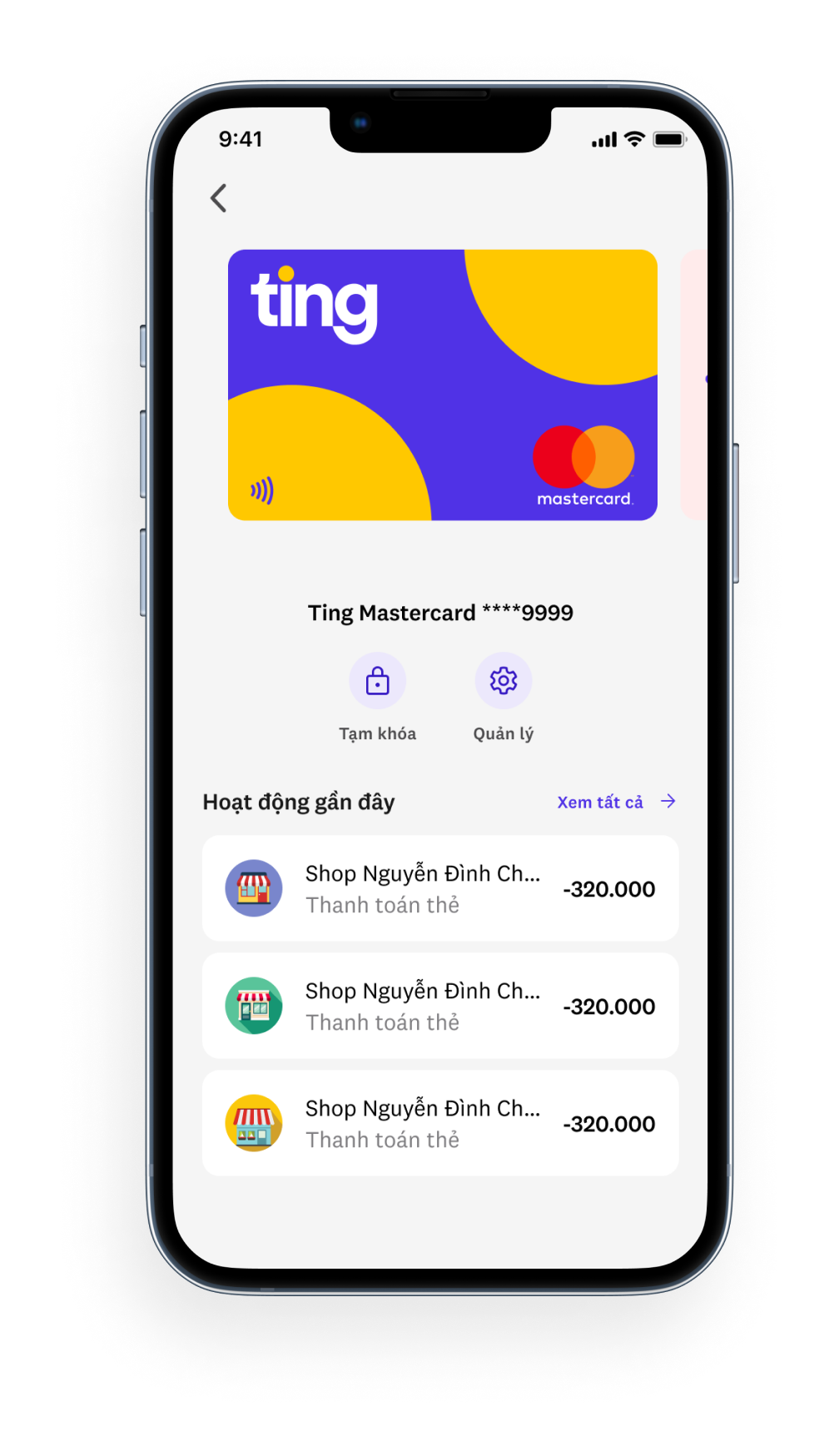

- Choose the right savings account: Open a safe and accessible account to keep your money. You have the option of choosing a high-yield savings account or a local bank account. However, make sure their terms, fees, and rates don't use up your savings.

Why Should Millennials Build An Emergency Fund?

Even as millennials in Vietnam make up a good portion of the working class and consumer market, they may not be as financially prepared as their older counterparts. In addition, not everyone has a stable job with a good paycheck that allows them to comfortably pay their bills every month.

An emergency fund is critical for a millennial living paycheck to paycheck. An unpredictable situation like another crisis or physical illness can strike, leaving a person with nothing.

Even with job security, people tend to spend more when they have additional cash at their disposal. The habit of saving for a rainy day will teach them to minimize impulse spending.

In addition, millennials are also delaying owning and investing in property in today's market. Young people can't keep up with increasing property prices in cities, making it impossible to be homeowners in a few years, despite the homeownership rate being 90%. Having funds for emergency expenses will preserve any other savings and investments a person has started and encourage them to reevaluate their financial goals and look for more opportunities for financial growth.

Wrapping Up

Regardless of any economic crisis or how much you earn, an emergency fund account needs to be part of your financial goals. Begin with what you have, stem any unplanned spending, and save more when you can afford it.

Our e-wallet is the automation tool you need to transfer your money securely and conveniently into a savings account. You can download it on your phone via Google Play Store or App Store.