We're now living in a world where, possibly soon, paper and card money will be replaced as more people embrace e-wallets. On a global scale, the volume of transactions from in-store and e-wallet payments is expected to rise beyond $10 trillion by 2025. Closer home, Vietnam was reported to have gained 19.2 million mobile wallet users in 2020, with the number of users set to rise almost triple from 2020 through to 2025.

Notably, the Asian continent, with China and India at the forefront, is on the verge of becoming global leaders thanks to factors such as governments' push for a cashless economy, a rise in e-commerce businesses, and an increase in mobile and internet users.

Essentially, e-wallets outdo physical money in terms of the safety, convenience, and flexibility they offer to business outlets and their customers. Users don't have to retrieve their physical wallets to access funds, as an e-wallet can be linked to their bank account, and with just a click, you can make purchases or transfer money.

The future is bright for digital wallets as more businesses, big or small, adopt digital transactions. This is a leading sign for young Vietnamese people to start or elevate their online businesses by optimizing e-wallet technology. This is one way to build your brand's reputation and gain leverage, as this will be a huge selling point to your prospective customers.

Read on to see 8 ways in which e-wallets can help your online business get more sales in 2022 and beyond.

1. Seamless Shopping

Convenient shopping and even faster checkout are one way to hook your customers. According to Baymard Institute, 26% of shoppers leave their carts if the checkout process is too long. E-wallets allow less friction as payment details and other important information are already fed into the app, enabling repeat customers to always shop on the go, increasing your sales volumes.

Retailers who have not adopted this way of doing business risk losing out on customers who prefer the speed and security that an e-wallet offers.

2. Better Customer Loyalty and Engagement

Digital wallet apps enable retailers to collect vital data about their customers. From this data, you can effectively determine your customers' tastes and preferences to customize their shopping experience with you. This can be done by personalizing how you communicate and provide value via coupons, special offers, and even loyalty programs. This is a great way to promote your online business to a larger audience.

3. Enhanced Security

In general, digital wallets and apps are safe due to the layers of security integrated. Every transaction made is encrypted via tokenization, requiring a password or biometric identification, making it hard to steal data. If you lose your phone, both the device and digital wallet can be disabled to prevent unauthorized access.

4. Elevated Branding

Mobile wallets offer you the perfect solution to bring promotional value to your business. You can achieve this by incorporating your shop's name and icon into the app, attracting more consumers to download it. Further, you can tailor the app's user experience in a way that makes it easy for targeted clients to search and proceed to engage with your platform without any barriers.

5. Improved Customer Service

One way to draw in today's millennials and Generation Z shoppers are to convince them you're the best at what you do. You can do this with stellar customer service through inbuilt chatbots in your e-wallet. Chatbots enable you to communicate with people at any time at a low cost. This boosts your revenues, as your customers view your brand as more attuned to their needs and will shop with you due to instant communication to their queries.

6. Capture More Online Shoppers

Your online shop will avoid the case of shoppers abandoning their shopping carts, provided you offer them an online payment option that eliminates the need for more authentications. Research shows that every year, online businesses lose $18 billion in revenue as a result of cart abandonment. With the pandemic transforming people's shopping habits, it has become easier to adopt digital wallets via smartphones.

This is a great opportunity for you to invest in a digital wallet for your business as the world is more open to safer and contactless payments. In turn, you will be better placed to capture this growing market demographic, leading to more sales.

7. Beacon Technology

Beacon technology has also gained traction in mobile proximity payments. Beacons promote increased access, as most smartphones are Bluetooth-enabled. So, every time a person walks in the store, a beacon placed at the front connects to the mobile wallet in the shopper's phone to alert them of a coupon being offered in their wallet. As an online shop owner, you can integrate beacons into your digital wallets to enable customization and gathering of valuable customer information. A big brand like McDonald's has in the past leveraged its marketing through beacons, leading to a 20% conversion rate out of 30% of users who got the promotion.

8. Cost Savings on Transactions

As digital wallets take over, retailers will no longer have to hire cashiers to check out customers, which is an eliminated payroll cost. Digital payments also save on printing costs in the generation of proof of payments, coupons, and other materials. It is also valuable to customers as this means lesser transaction costs for them. The reduced costs will ensure you earn more profits, which you can reinvest into the business.

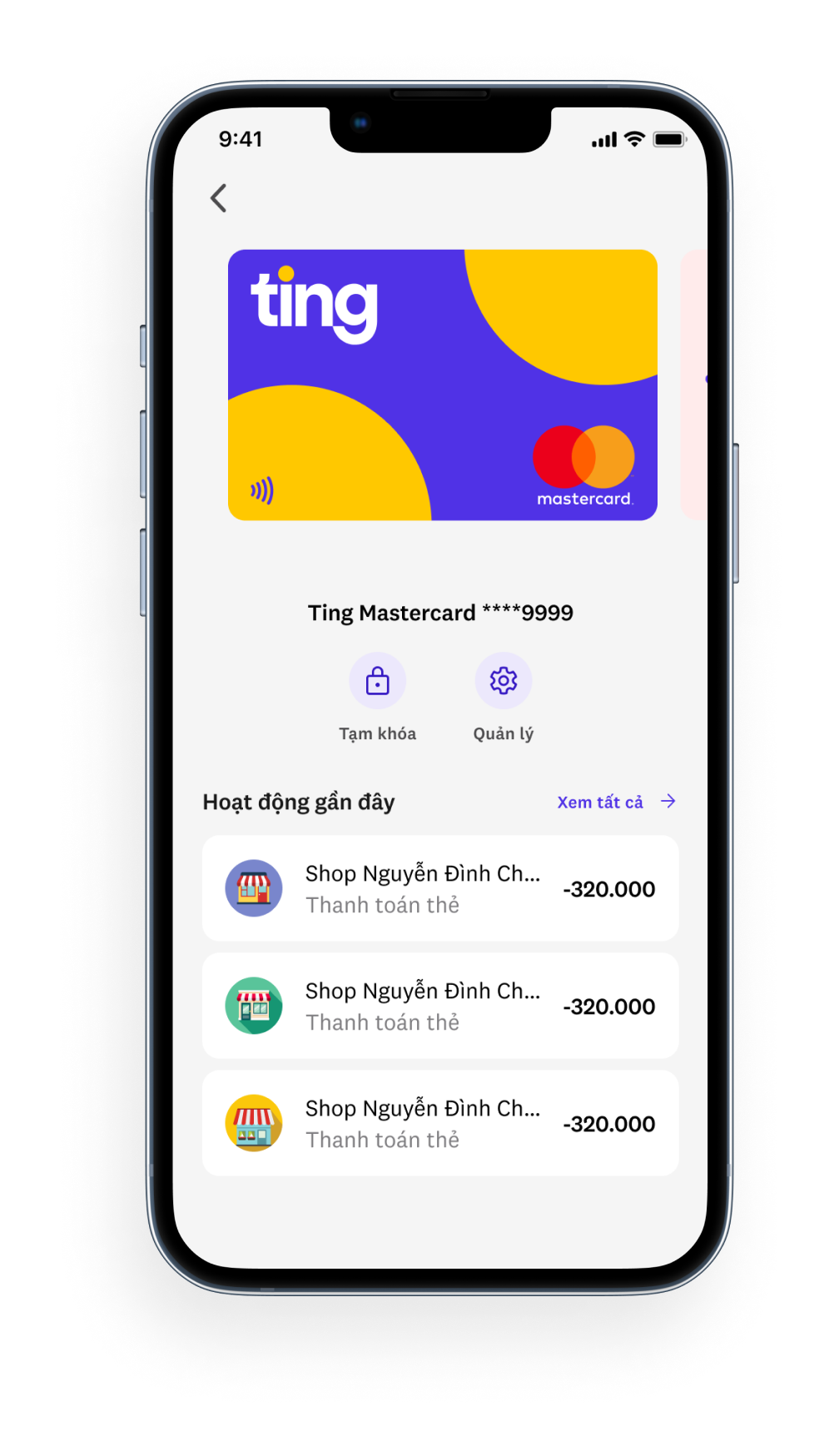

Let Our E-Wallet Do the Work for You

What next? If you want your online shop to scale upwards in a tightly competitive market, our Ting e-wallet is a valuable tool to have. Not only do you safeguard your transactions, but your customers never forget the great experience they have while buying from your shop. You can also manage your expenses conveniently and quickly. Further, it's as simple as downloading, and soon you can track your shop's conversion rates.

You can get the Ting e-wallet from the app store or Google Play directly into your smartphone for the best user experience.