Are you worried that you may not be saving enough money in a month? If you are, you should know that you aren't alone in this. Many people are finding it hard to save money. They spend what they earn and set aside whatever they are left with. If you continue this way, you may not have money to take care of your financial emergencies or even invest.

You need to take care of your monthly expenses. If your expenditure is making it difficult for you to save, you should do something about it. Fortunately, it's possible to save more, regardless of your monthly expenses. One of the most important personal finance tenets that you shouldn't ignore is to "pay yourself first."

What does "paying yourself first" mean? It's setting aside a given proportion of your monthly earnings in a savings account or a retirement plan before you take care of your expenses. The idea may seem scary to you as you don't want to be in a position where you fail to pay your monthly expenses. However, it's the best strategy to achieve financial security.

Why Should You Pay Yourself First?

Most people underestimate the importance of saving. You shouldn't fall into this trap, as it may derail your chances of achieving financial freedom. Regardless of the amount you earn or the expenses you have to pay for, pay yourself first. Why is this strategy good for you?

- It enables you to take care of your financial emergencies.

- You can secure your financial future.

- Current and future investments become easy (car, home, and business).

- You can comfortably afford luxurious vacations.

- Why Is Saving Difficult for People?

- If you are struggling to set aside the money you earn, you should know you aren't alone. Saving is an art that most people and households haven't mastered.

What are the main reasons you may find it difficult to save?

You Take Care of Many Expenses

Just like everybody else, you have expenses like rent, food, electricity, and water bills, among others. In some cases, you may feel overwhelmed financially. You are left with nothing to save, or you may even have to borrow. If this scenario keeps recurring, you need to assess your financial lifestyle and make the necessary changes.

You Don't Have a Financial Goal

If you don't have a reason to save, you may end up spending all the money you earn. A financial goal gives you the motivation to set aside a reasonable portion of your earnings. The goal could be a property you want to purchase, a vacation, education, or business. Moreover, you should understand that you could lose your job and need money to take care of yourself as you search for a new one.

The People Around You Don't Save

Although you may want to save, the people around you may prevent you from doing so. For instance, you may have friends who are heavy spenders. You may have the urge to purchase the latest gadgets to compete with them. If you want to succeed in your saving journey, associate with people who believe in it.

Saving Isn't a Priority for You

At some point, you may have thought about saving. However, you keep procrastinating. You shouldn't treat saving as an afterthought. Let it be an important part of you.

Your Money Habits Won't Allow You to Save

It's important to live within your means. However, some people go on a spending spree when they earn. They end up using everything and even borrowing. If you're in this category, you need to reevaluate yourself.

How Do You Make the "Pay Yourself First" Strategy Work?

At this point, you already know the meaning of paying yourself first. The next step is to make things work in your favor. How do you go about paying yourself first and attaining success? Here are the strategies you should use:

Analyze Your Earnings and Expenditures

You shouldn't set the amount you intend to save before you understand your financial situation. If you do, you may end up in problems. Saving too little means you may not achieve your financial goal. Setting aside a big proportion of your monthly income makes it difficult for you to pay your expenses.

The first step towards success in paying yourself first is to evaluate your expenses. Your fixed expenses include rent, health insurance, and loan repayment. The variable ones include entertainment, home repairs, and food. Compare these expenses to your earnings and identify the lifestyle changes you can make to save more.

Set A Realistic Saving Goal and Commit to It

You now have a better understanding of your financial position. Financial experts suggest that you should use the 50/30/20 rule; 50% of your earnings should go to basic expenditure including food and accommodation, 30% for luxury, and 20% for saving. However, you don't have to adhere to this rule. You can still reduce the amount you spend and save more.

You don't want to begin saving now and stop the next day. That's where financial commitment comes in. Autopilot saving can help in this case. Open a savings account and set it such that a percentage of what you earn is automatically deposited into this account every month.

Evaluate Your Progress Periodically

As you use the "pay yourself first" strategy to increase your savings, you should understand that circumstances change. For instance, you may receive a salary increment. Besides, the cost of living may reduce. Such events make it easy for you to increase your savings.

However, you should also keep in mind that some events may hamper your ability to save. A pay cut is a good example. Take time to review your financial circumstances and make the necessary adjustments. Regardless of the challenges you face, you shouldn't back out of your "pay yourself first" strategy.

Final Thoughts

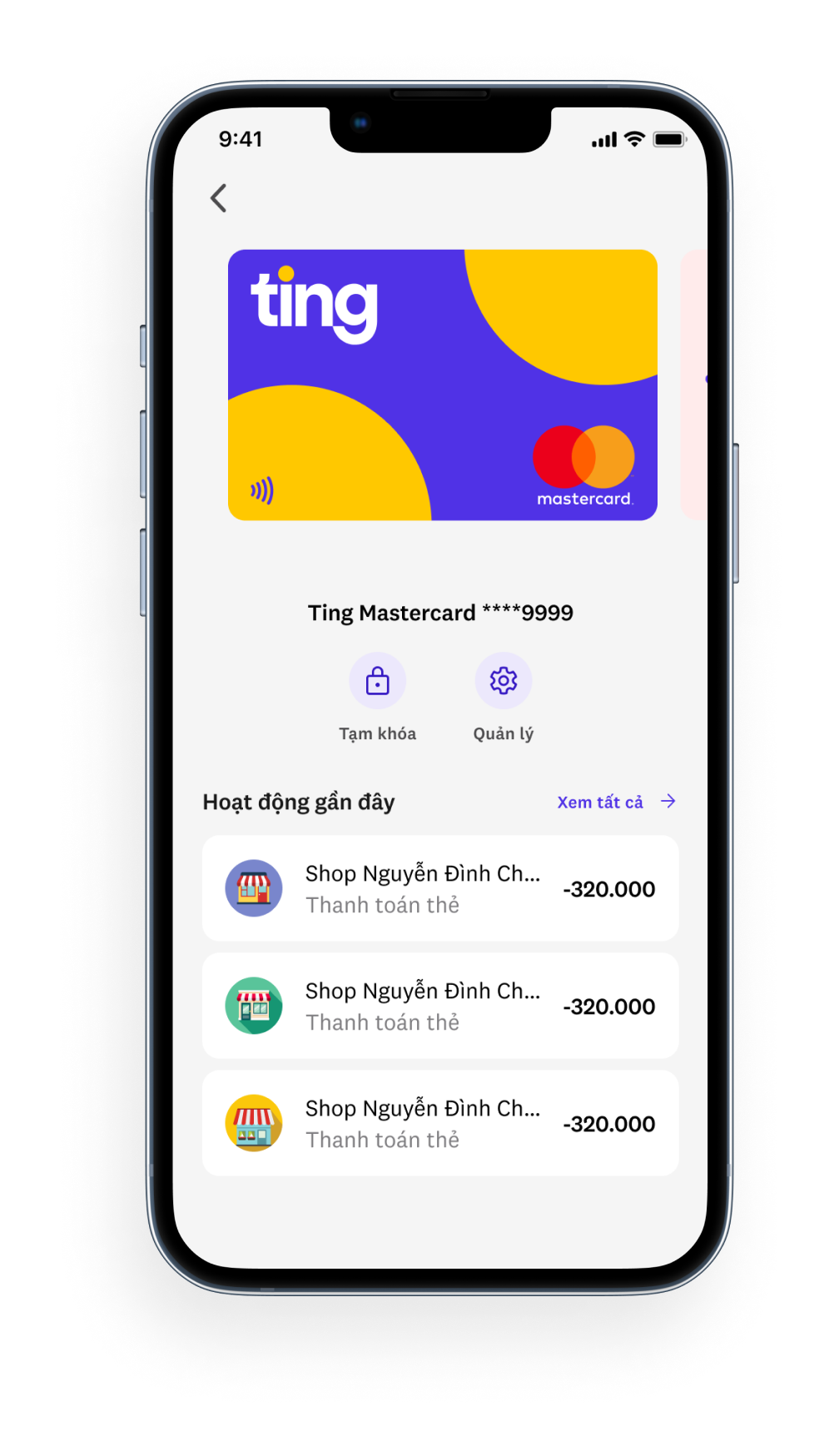

You need to boost your savings as you launch your journey towards financial freedom. The pay yourself first strategy helps to achieve this. As you work on your finances, we're here to make everything easy for you. Ting e-wallet is continuously working toward making personal money management seamless, straightforward, comfortable, and convenient. Contact us for more information.