If the thought of starting a savings plan seems too far-fetched, you're not alone. As a young adult, your fear of investing is expected and justifiable since you don't know where and how to invest. However, even with events such as the Great Depression and the 2020 stock market crash, people are still investing. By the second quarter of 2021, the global stock market was trading at $37.7 trillion, according to Statista. Everyone should invest as it's proven to be the best way to build wealth, but it's even more impactful when you begin at a young age.

Why Invest?

Investing protects you from financial insecurity. The ongoing erratic inflation and global instability should be a reality check that investing is critical. Having an investment portfolio will help beat inflation and preserve your money.

Investing is also a great way to achieve your financial goals. Steadily growing investments will provide funds to pay for the down payment of your first home or pay for college fees.

Moreover, putting aside money for investing helps to afford you a comfortable retirement. When you're in your 20s, you have more working years to contribute towards your pension.

How Do You Start Investing in Your 20s?

Investing in your 20s will assure you of a great legacy, as you're in the best position to take more risk and invest in as many assets as you want. To start investing, begin by understanding who you are. Ask yourself questions such as:

- What's my goal for investing?

- What is my risk tolerance?

- What do I want to invest in?

- How much money do I want to invest?

Knowing where you stand as an investor provides the road map of investing and the type of returns you will earn in 20 to 30 years.

Best Investment Options to Invest in as a Young Person

Picking your investment options carefully improves your chances of getting exponential returns. Generally, every investor needs to understand their risk profile and time horizon. Another critical factor in building and maintaining a strong portfolio over time that is safe from volatility. Here are different types of investments to choose from:

1. Stocks

From January through to October 2021, around 1.1 million stock trading accounts were registered, higher than in the entire year of 2020. Buying and selling of shares are popular due to the potential of earning high returns and great dividends. It also allows you to invest in a company you respect as you have an ownership stake. A common piece of advice given by financial advisors is to invest a high percentage of your money in stocks since you're still young enough to persist through any market fluctuations. It also pays to do some solid research on companies you're putting money into.

2. Real Estate

Investing in real estate while still young is the best move to build long-term wealth. You can make money from house flipping, renting, buy-and-hold, and REIT investing. With enough finances, you can start with your first house, and in 10-20 years, you'll be able to add more properties. If the typical 20-30% down payment is beyond your means, you can consider REITs as a way to earn returns from residential and commercial real estate without directly owning property.

3. Savings Accounts

A high-yield savings account offers the best place to allow your savings to grow with little to no risk. Banks are now offering attractive interest rates for online savings accounts with 6-12 monthly terms, from 7.15% to as high as 7.4%. Apart from the better interest rates, you can seamlessly manage your cash from a mobile app without entering a banking hall. Whether you're a student or working, you can set aside an amount you're comfortable with, depending on the minimum deposit required.

4. Certificates of Deposits (CDs)

You can also access Certificates of Deposit (CDs) from your local bank. In 2019, banks moved to increase the interest rates of CDs to as high as over 10% to attract more clients. Essentially, when you deposit money into a CD for a specific period of time, banks pay you a higher interest rate. The maturity periods can be from 6 months to 5 years, where you can't access your money or risk losing interest.

5 Effective but Practical Tips for Young Investors

When you're in your 20s, you have time to make mistakes and learn from them. A small paycheck should also not stop you from achieving financial security. It's prudent to look at investing as a long-term objective to carry you over during the ups and downs of the economy and investment markets. To be a savvy investor, you need to be mindful of a few things:

1. Start Investing Now

There's never been a better time to start your investment journey than the present. As a 20-something, you have decades to maximize the power of compounding interest. An initial deposit of $1,000 at age 20 will grow to $247,830 when compounded monthly by the time you're 50 at a 10% annual interest rate plus $100 monthly deposits. If you have children and a mortgage later on, you can comfortably handle the financial responsibilities as you'll have more resources.

2. Learn About Money Management and Investing

It's vital to educate yourself about financial concepts, budgeting, and the market to avoid making financial blunders. If you want to invest in shares, start by looking into how the business makes its money, its debt-equity ratio, and sustainability in the industry. Before buying a real estate property, learn about mistakes other investors have made, such as overlooking hidden costs.

3. Become a Good Manager of Your Debts and Savings

Should you pay debts first or invest? Well, this depends on your financial circumstances. If you wield credit card debt with high-interest rates, you may be forced to pay it off first. If you also don't have an emergency fund, it's better to get started. But if you can, aim to pay your loans and invest at the same time. Nevertheless, it's good practice to avoid reckless spending, which is a culprit of accumulating debt and zero savings.

4. Diversify Your Portfolio and Embrace More Risk

No investment option lacks risks; that's why your asset allocation matters. An ideal asset allocation requires a mix of the most aggressive and the safest assets to make sure you earn great returns. This involves a combination of stocks, bonds, real estate, and CDs. Since you're young, you have a longer time horizon, so you can invest heavily in equities that promise higher yields. There's also nothing wrong with being conservative, only that you stand to lose huge gains.

5. Seek Help in Building Your Investing Plan

Building and maintaining a portfolio can be challenging if you can't balance your asset classes. Most successful investors have a team of professionals such as financial advisors who handle the investment strategies and select the most profitable securities. As a young investor who may not afford an advisor, you can check out the different online brokerage and trading platforms in Vietnam. BrokerChooser offers great information on how to open an account, fund it, find and buy shares, and a list of the best online brokers.

Invest in Your Financial Future

What kind of future do you want? If it's the kind where your finances can fully cover your needs and wants, then investing is right for you. Just be watchful of how your money grows, explore different approaches to investing, and continue learning to keep up with the market trends.

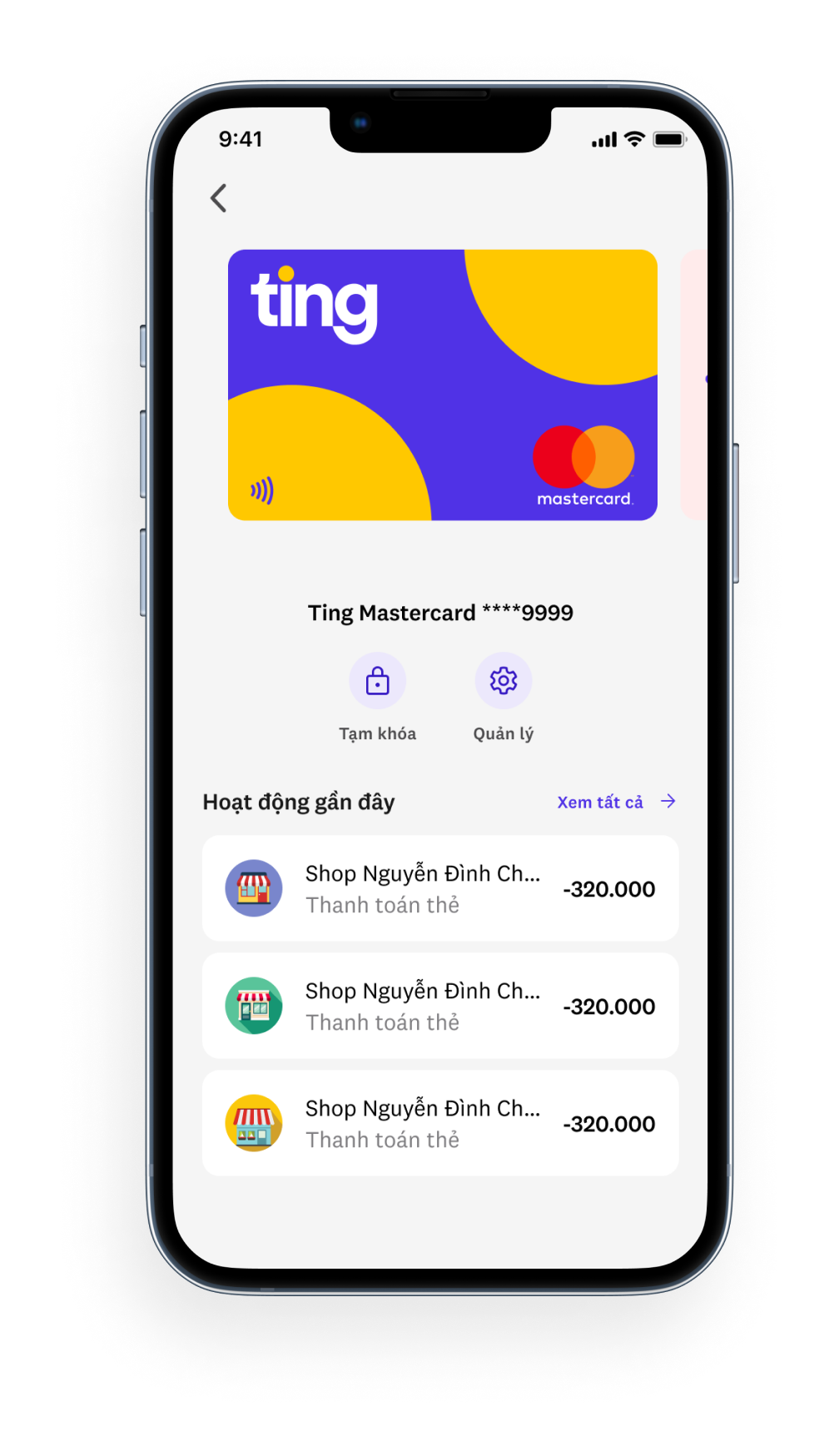

Being tech-savvy will also enable you to take advantage of the available market trend analyses and resources via trading platforms, apps, and websites. Ting is a useful tool to get you in the momentum of saving towards your investments. It's as simple as downloading the app and making transfers to your savings and checking accounts from your smartphone. Get in touch with us today to learn more.