Managing your money is the best thing to do for your financial health. If you're young and are already earning income, this is the best time to be serious about savings and investments. You not only have the advantage of time, but it lets your money grow on compound interest.

However, you have to be financially literate in the first place. The good thing is, young people in Vietnam can have the chance to be financially equipped through the support of financial institutions that organize sessions like the 2019 Vietnam Global Money Week.

That aside, not everyone applies the same personal financial advice due to factors such as income and lifestyle. Money management is not that simple, after all.

Why Is Money Management Difficult?

Incomes are not the same

How much you earn predetermines how much you save and invest over time. The lifestyles of a person who earns a big salary and the one earning minimum wage can be vastly different. You don't have to deal with many competing interests between your living expenses and investments if you have a big paycheck.

There's a lot of information

Every time you check your social media or the local news, there's always something about the latest hot stock or cryptocurrency. Your friends and family also influence your money choices one way or another. With all the information overload, making the right money choices can be overwhelming.

Life is complicated

How your childhood turned out will ultimately impact your financial habits. Your parents, siblings, and other relatives may have taught you either negative or positive money traits. When you become an adult, you're overall responsible for your living expenses, and sometimes you deal with which can unplanned expenses derail your financial goals.

While you may not have a choice over who your family is or your financial situation, you can take control of your income and information while finding what works for you.

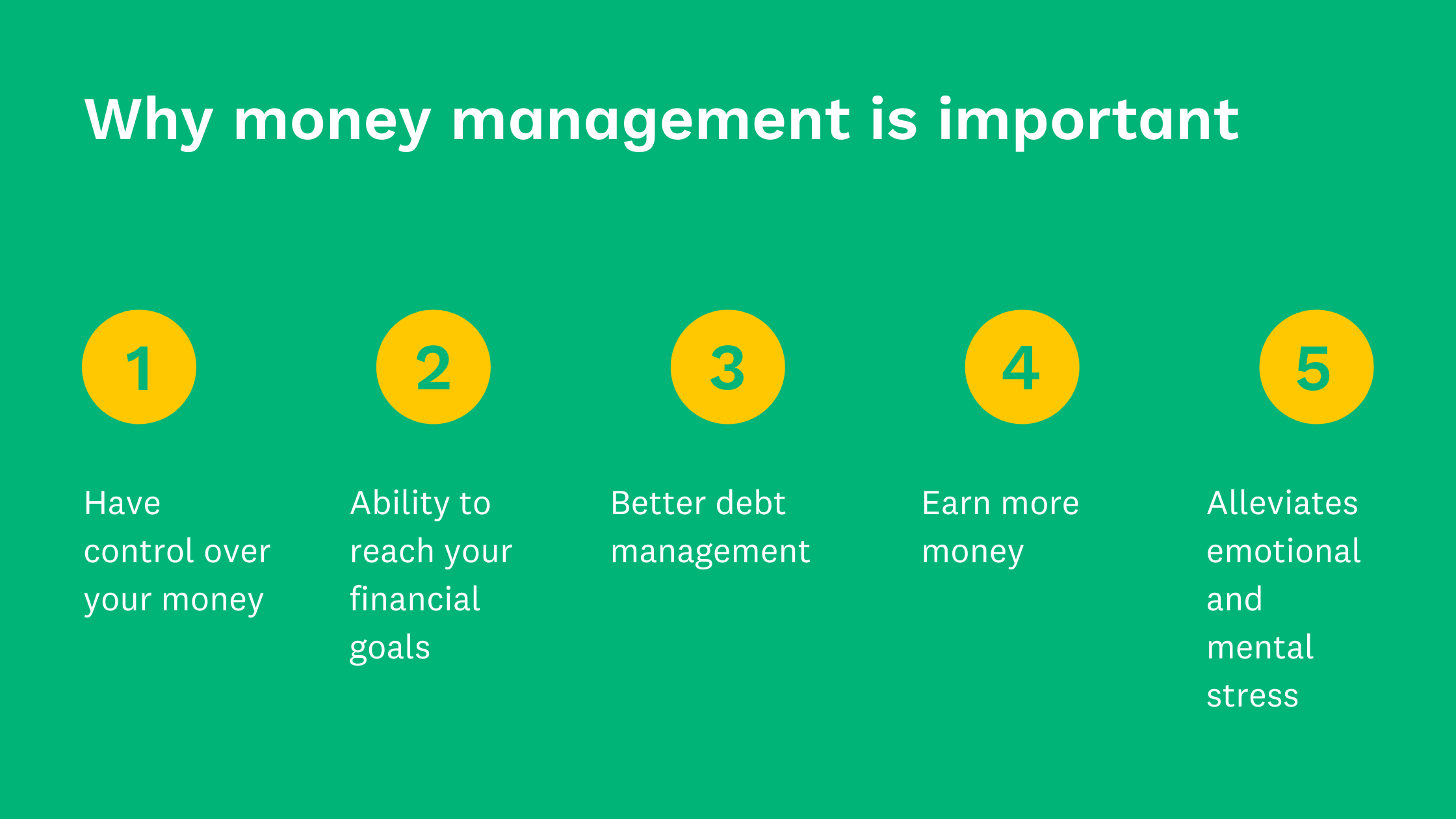

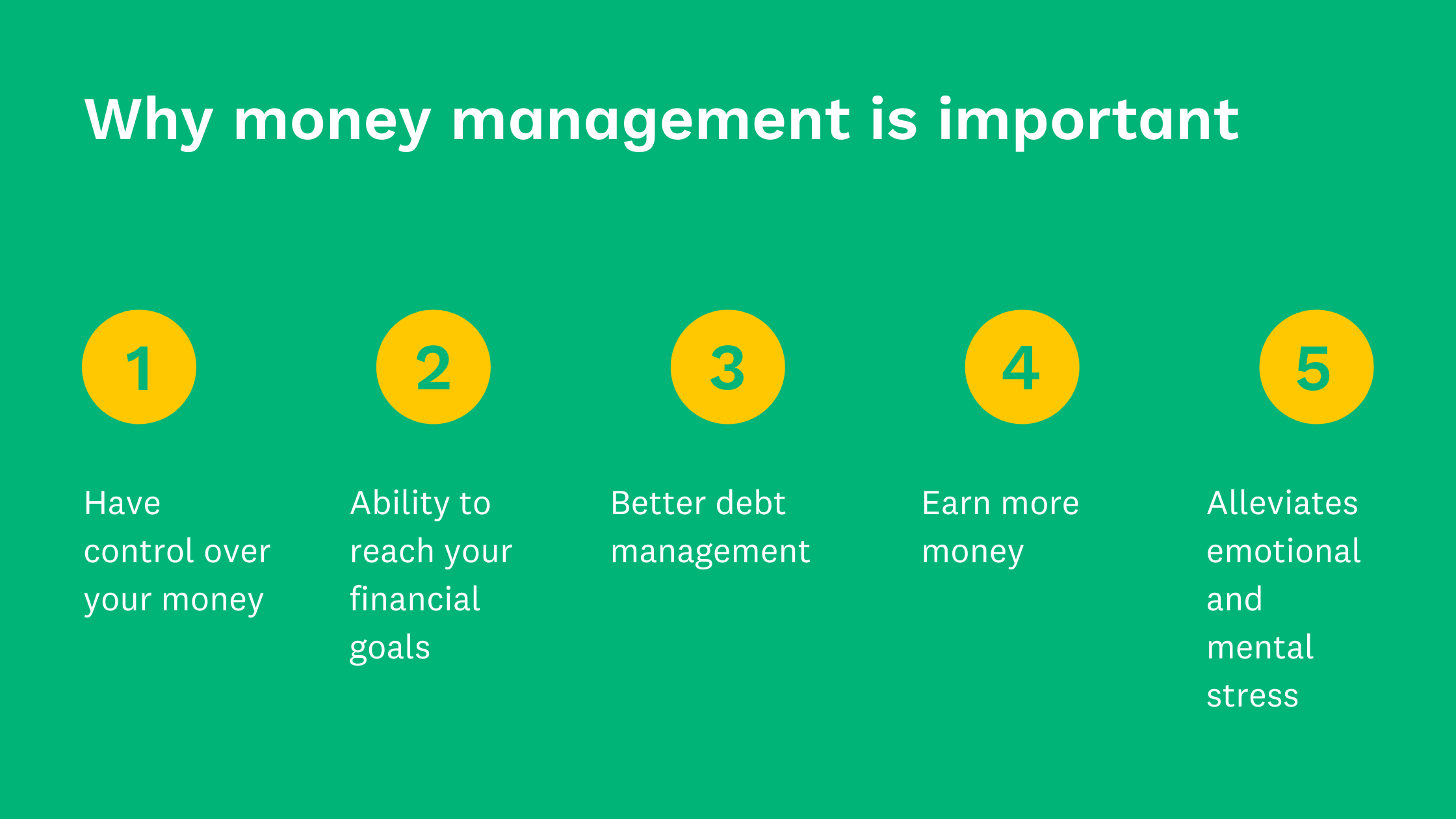

Why Money Management Is Important

Earning a good income is not enough to make you a good manager of your money. It involves having a better understanding of how money works and finding the right principles that will bring you financial wealth. However, it takes time and consistency to be an expert at it.

Benefits

- Have control over your money: Having money management skills means you're keen on how you make and keep your money. A budgeting app helps to keep you disciplined as it automates money allocation. Building wealth requires accumulating your money and balancing your portfolio. This is a long-term project, and you're the best person to steer it.

- Ability to reach your financial goals: Paying attention to your money will encourage you to have and work on your financial goals. If you dream of owning a home or having a good retirement, it's possible only if you take charge of your money. It makes you take deliberate financial management steps, allowing you to live stress-free, knowing your future is set.

- Better debt management: When you're invested in your finances, you will work to avoid accumulating debt. Debt can take a large portion of your disposable income, making your financial goals a pipe dream. If you do have debt, it will be easier to come up with a payoff plan so you don't struggle with achieving financial security.

- Earn more money: Learning how to manage your money also involves developing an investment strategy and diversifying your portfolio to various asset classes. With time, your investments will pay off, allowing you to live the type of lifestyle that your normal income may not afford you.

Alleviates emotional and mental stress: Financial stresses like living paycheck to paycheck or huge student loans can keep you awake at night. Controlling your spending allows you to prioritize your bills and decide how much to save and invest. Knowing how your financial future may turn out gives you peace of mind and improves your emotional and mental health.

5 Money Management Tips

Learn About Money

You can't expect to manage money if you lack a basic understanding of its concepts. For example, if you don't know how compound interest works, you're missing out on building wealth. Compound interest works best with time, and when you're younger, you have time. If you can't tell apart good or bad debt, it's easy to end up with credit card debt that may take you a lifetime to pay off. Being financially literate gives you the tools and presence of mind when dealing with money. You can sign up for financial newsletters, or download free personal finance ebooks to learn more.

Track Your Expenses

Lacking awareness in your spending will lead to living beyond your means. Whether you earn a low or high income, it's imperative to know how you spend across all your expense categories, both essential and nonessential. You need to have a budget showing your weekly or monthly spending to avoid wasting money. When you know you can make next month's rent, it prevents you from getting into debt, and instead, you focus on how you can make more money for a better quality of life.

Build and Maintain an Emergency Fund

This is one of the most repeated but valuable financial tips. When you have money set aside for emergencies, it allows you to be worry-free over your survival. Don't wait until you're earning enough or have no debt; just start now with what you have. Three or six months' savings can adequately cover your living expenses. Open a high yield savings account where the money grows and is easy to access when you need it. This also ensures you don't dip into your other savings for retirement or down payment for a home.

Start Saving for Retirement

If you want a better future for yourself and your family, plan for retirement now. This allows compound interest to work greatly in your favor. Going by the average income in Vietnam, which is $277, a 25-year-old adult can save $55 every month. When it is compounded monthly at an annual interest of 12%, in 40 years, using a compound interest calculator, their money will accumulate to $653,588. As you keep saving what you have, you will eventually be able to earn more, letting you further boost your savings.

Have an Investment Strategy

A long-term investment strategy will enable you to stay on top of your money management. You require having a well-balanced portfolio that will generate high investment returns in the future. You can consider working with a financial professional who understands your risk profile and time horizon. If you're in your 20s or 30s, you can afford to invest a portion of your income in high-risk investments such as stocks which will earn you significant returns. You can also invest in closed-ended funds or exchange-traded funds (ETFs) to spread risk.

The Bottom Line

Good money management aligns with good money habits. Work to replace your bad habits with good ones to get the best of your finances. You still have time to earn and try new ways more than someone who is older and has huge responsibilities and can't afford to make mistakes. You will not run out of money to support yourself with good money management skills.

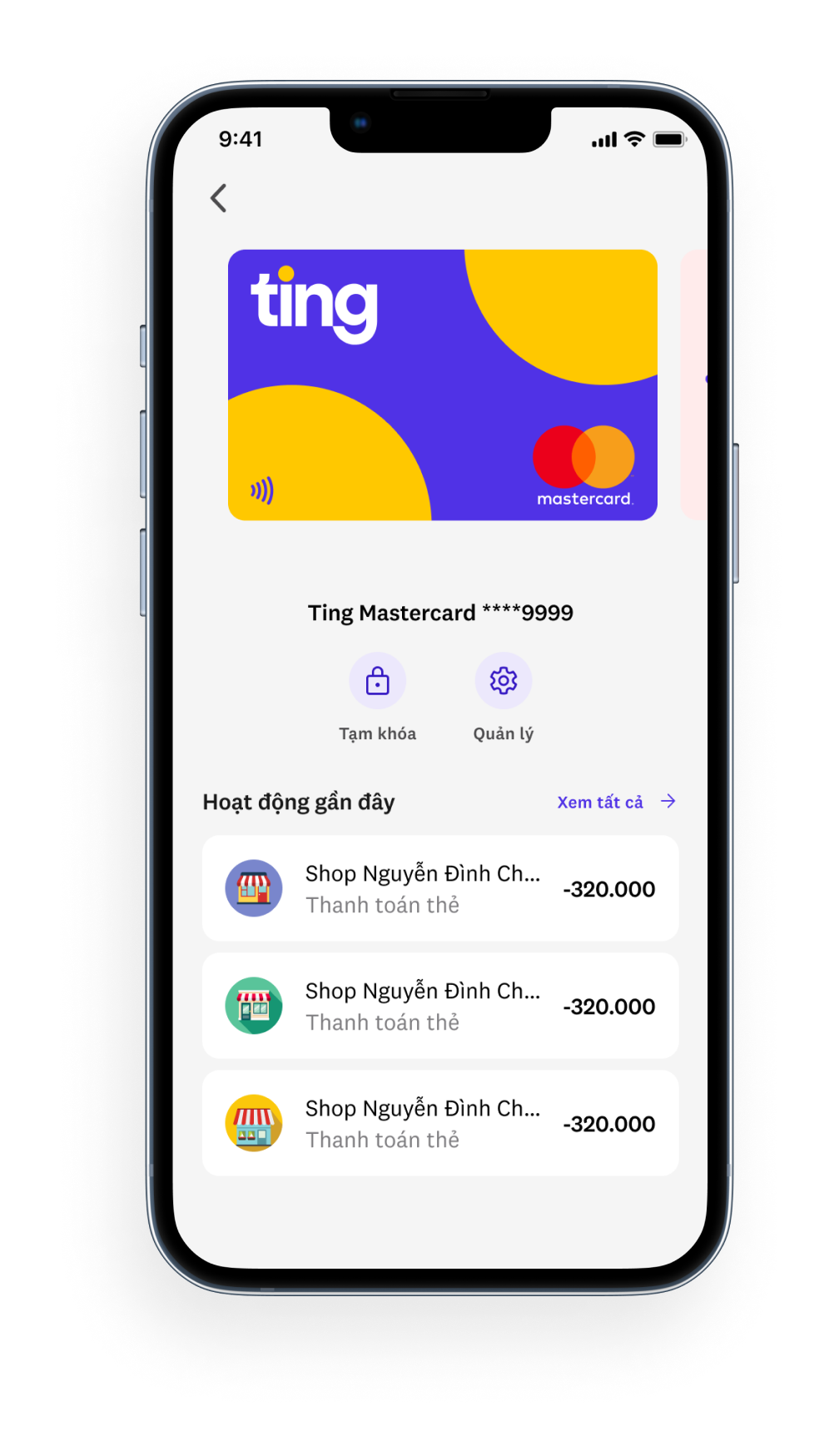

Start your journey for better money management by downloading our Tingapp, an e-wallet that lets you automate and secure your payments and transfers. Our Ting teams are always available to answer any question you have. Get started today.